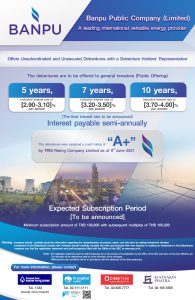

Banpu to Issue and Offer 3 Tranches of Debentures to General Investors, With A+Ratings and Indicative Interest Rate of [2.90-4.00]% per annum Subscription Offered through 4 Top Financial Institutions

Banpu Public Company Limited or Banpu, a leading international versatile energy provider, is issuing and offering three tranches of debentures to general investors through four leading financial institutions. TRIS Rating, on 9 June 2021, affirmed the ratings on Banpu’s debentures at A+, indicating the Company’s strength and potential for future expansion of its integrated energy solutions business.

Mrs. Somruedee Chaimongkol, Chief Executive Officer of Banpu Public Company Limited, reported the submission of the Company’s registration statement to the Securities and Exchange Commission (SEC) for the issuance and offering of unsubordinated and unsecured debentures with a debenture holders’ representative in the name-registered certificate. The debentures will be offered to the general investors in 3 tranches: the 5-year Debenture with indicative interest rate of [2.90-3.10]% per annum, the 7-year Debenture with indicative interest rate of [3.20-3.50]% per annum, and the 10-year Debenture with indicative interest rate of [3.70-4.00]% per annum. The exact subscription period will be subsequently announced. The debentures will be offered through four underwriters, namely Bangkok Bank Public Company Limited, Krung Thai Bank Public Company Limited, CIMB Bank (Thailand) Public Company Limited, and Kiatnakin Phatra Securities Public Company Limited via regular branches and online systems or mobile applications.

“We believe that Banpu’s debentures will receive a good response from the investors planning to invest in a stable and leading company in the industry with growth potential, as affirmed by TRIS Rating’s “A+/Stable” credit rating on 9 June 2021. Amid the challenges of the COVID-19 pandemic facing the industry, Banpu has maintained strong financial discipline and cash management. Driven by the Greener & Smarter strategy, we continue to grow steadily. This has made Banpu’s debentures a viable option for investors considering diversifying to assets that yield satisfactory returns at acceptable risk,” added Banpu’s CEO.

Following its 5-year business plan for 2021-2025, Banpu is ready to mobilize its businesses and pursuing its Greener & Smarter strategy with determination to become a leading International Versatile Energy Provider. At present, the Company operates assets in 10 countries: Thailand, Indonesia, China, Australia, Lao PDR, Mongolia, Singapore, Japan, the United States of America, and Vietnam. Banpu’s growth is built on 3 core groups of businesses. Energy Resources comprises coal and gas, including related operations such as marketing, trading, logistics, fuel procurement, and transmission. Energy Generation includes thermal and renewable power plants. Seeing steady growth in electricity demand across Asia-Pacific and the importance of eco-friendly energy, Banpu feels prompted to diversify its energy portfolios for sustainable growth. It sets to achieve the generation capacity target of 6,100 MW by 2025 while seeking a balance between generation capacity and energy demand to lay a foundation for a sustainable energy in the future. At present, Banpu has partners in the Energy Generation Group both in Thailand and abroad to ensure reliable delivery of electricity for the community, economic and social development, and environmental protection. In early June, the Company acquired two utility-scale solar farms in Australia with a total power generation capacity of 166.8 MWdc . The two solar assets have entered into power purchase agreements with offtakers who have a strong credit rating, ensuring a long-term and stable revenue stream. The third group, Energy Technology, consists of solar rooftop and solar floating power generation, energy storage system, electric vehicles, and smart city solutions development. This business group is accelerating exponential growth in solutions development and service expansion to satisfy customer needs in the New Normal era.

For the first quarter of 2021, Banpu reported operating results with a net profit of USD 51 million (approximately THB 1,543 million), demonstrating the ability to maintain continuous operations despite economic uncertainty. The total sales revenue was reported at USD 736 million (approximately THB 22,269 million), increasing USD 102 million or 16% increase compared to the same period last year. Cash and cash equivalents worth USD 936 million (approximately THB 29,336 million) were set aside to cushion potential volatility.

Banpu’s CEO also noted that by integrating conventional and renewable energy and energy technology businesses – into the corporate structure, Banpu can synergize its core groups of businesses to efficiently leverage resources. Thus, the Company can simultaneously create balance and expand businesses that answer the needs of consumers, communities, society, and the environment.

The Company also received Excellent CG Scoring, the highest level of recognition in the annual CG assessment conducted by the Thai Association of Directors (IOD) in collaboration with the Stock Exchange of Thailand (SET) and the Securities and Exchange Commission (SEC). Moreover, the Company remains on the THSI (Thailand Sustainability Investment) list of selected listed companies with outstanding performance in Environmental, Social and Governance (ESG) aspects. Banpu has also been selected as a member of Dow Jones Sustainability Indices (DJSI) for seven consecutive years. All these recognitions reflect Banpu’s commitment to sustainable business practices toward “Smarter Energy for Sustainability” to balance economic, social, and environmental sustainability. The Company also aims to create stable long-term returns for shareholders and investors and deliver sustainable value to all stakeholders in ten countries where Banpu has operations.

Due to the outbreak of COVID-19, we have added more subscription channels for Banpu’s debentures for the convenience of investors. General investors who are ordinary persons can subscribe for all three tranches online, via mobile applications, or phone service. There is no need to visit the underwriters’ branches or sales offices. Starting today, interested investors can contact any of the four underwriters for more information.

Currently, the Company is in the process of filing a registration statement and draft prospectus, which have not yet come into force, pending consideration by the SEC. For general investors interested in subscribing for Banpu’s debentures, please visit www.sec.or.th for further information or contact the following underwriters:

– Bangkok Bank Public Company Limited, except micro branches, Tel. 1333

– Krung Thai Bank Public Company Limited, Tel. 02-111-1111

– CIMB (Thailand) Bank Public Company Limited, Tel. 02-626-7777

– Kiatnakin Phatra Securities Public Company Limited (including Kiatnakin Phatra Bank Public Company Limited as an underwriter), Tel. 02-165-5555