Banpu reports overall stable performance in the first half of 2020 Gearing investment towards instant cash-flow generating businesses

Banpu Public Company Limited (BANPU), a leading integrated energy solutions company in Asia Pacific, achieved stable results for the first half of 2020 through its key focus on increasing and maintaining cash flow by the acceleration of closing of Barnett shale asset transaction in the U.S., the acquiring an operating wind farm in Vietnam, and constantly introducing new products and services from the Energy Technology business group. Despite the impact from the COVID-19 crisis that has lessened the global demand for fuel and the strong Thai Baht appreciation, Banpu managed to maintain an overall stable performance in the first half of the year resulting from several

short-term measures including organization-wide cost reduction coupled with operational adaptations that focus on short-term wins.

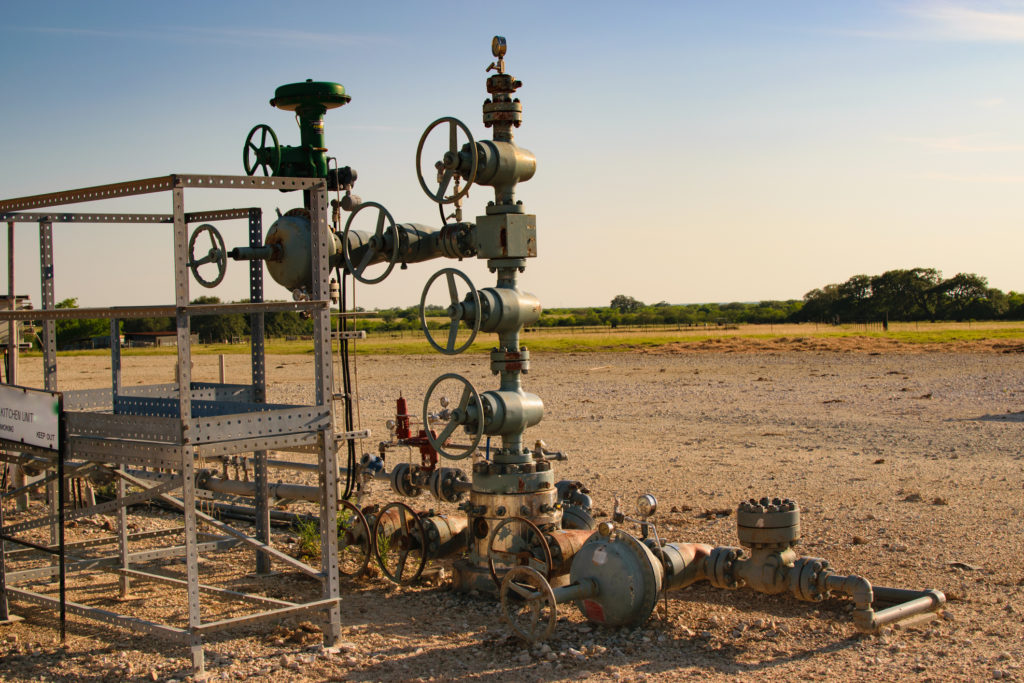

Mrs. Somruedee Chaimongkol, Chief Executive Officer of Banpu Public Company Limited, revealed that “In the first half of 2020, Banpu faced with several challenges from the impact of COVID-19. In bid to stabilize business performance and confidence for shareholders and investors, we made every possible effort to achieve business growth and sustainability by implementing various short-term effective measures. These include reduction in operating costs of the Company and our subsidiaries by 20 percent, postponing investment in new high-risk businesses, focusing on the investment in the countries with high opportunities with low financial risks, carrying on trading deals with pricing insurance contacts to mitigate the fluctuation risks, and acquiring El Wind Mui Dinh wind farm in Vietnam with an investment value of USD 66 million (approximately THB 2,038.74 million), which is already in commercial operation and helps increase revenue and cash flow from renewable energy portfolio for the Company within this year. In addition, Banpu has successfully acquired the Barnett shale in the U.S. and accelerated the closing of transaction from the previously arranged of 31 December 2020 to 1 October 2020 or one quarter earlier. The acceleration of the closing would immediately increase the scale of Banpu US shale gas operations and strengthen in gas business with realization of additional contribution from Barnett operational results since 1 September 2019.”

For the Energy Resources Group, in addition to accelerating the closing of the Barnett shale transaction which enhances cash flow management capability, the Company has also implemented measures to reduce capital expenditures (CAPEX) and operating expenses, due to the slowdown of economic activities and decrease of fuel demand in the industrial sector during the COVID-19 crisis, which resulted in the oversupply and decreased average selling price (ASP) of coal. However, the outlook for the second half is expected to recover to last year’s level after many countries’ economy may begin to show signs of a rebound. At the same time, Banpu has constantly applied digital technology to optimize production capacity in the coal business effectively.

The Energy Generation Group still retained reliable operation and generated strong cash flow and profit. BLCP power plant continued to achieve solid operational performance with the Equivalent Availability Factor (EAF) reported at 100 percent. Hongsa Power Plant presented EAF of 63 percent due to the temporary shutdown of its production unit 3 from the end of April until August 2020 in order to improve the efficiency and long-term operability after malfunctions of some equipment in the machine were detected, which now resumes its operating at full capacity. Solar farms in China and Japan achieved a stable production capacity. The construction of the Shanxi Lu Guang power plant in China has currently reached over 83 percent completion and expected to be fully completed on schedule, and start generating income in the fourth quarter of 2020.

The Energy Technology Group also achieved its previously-set business goals and continued to expand its technology portfolio to offer new energy alternatives to improve the quality of life of people across all sectors of the society. This business group reflects Banpu’s commitment to social and environmental responsibility in every country where it operates. Solar rooftop system is key revenue-generating business with current production capacity of 172 MW and is likely to continue growing. The business group has also introduced new energy solutions to meet different needs of both business, industrial and individual customers, such as the launch of new service routes for MuvMi, an electric ‘tuk-tuk’ service, and the recent launch of electric ferries (e-Ferry), the first e-Ferry for tourism in Thailand.

“Amidst the challenges during the first half of 2020, Banpu is still able to maintain positive business performance by executing the Greener & Smarter strategy and the 3Ds of energy, comprising Decentralization, Decarbonization, and Digitalization. We also emphasize the concept of ‘Working Agility’ and ‘Banpu Heart’ corporate culture, which stand for our preparedness to cope with unexpected changes and can go through any crisis over years,” concluded Somruedee.

Banpu reported its operating results for the first half of 2020 with a total sales revenue of USD 1,151 million (THB 36,334.10 million), EBITDA (Earnings Before Interest, Taxes, Depreciation and Amortization) of USD 235.9 million (THB 7,286.95 million), and net loss of USD 23 million (THB 801.70 million), mainly due to the weakening of fuel prices and the baht appreciation rapidly this quarter. In addition, the Company realized one-time expense related to converting and changing of interests in BKV Oil & Gas Capital Partners, L.P. as a limited partner to be the common shareholders in BKV corporation that was established on 1 May 2020. This restructuring has enhanced Banpu’s management ability and fostered strong growth in shale gas business. Such transaction was non-cash item, it has no impact to the Company’s cash flow and dividend payment.

# # #

About Banpu

Banpu Public Company Limited is a leading integrated energy solutions company with 3 core groups of businesses: energy resources, energy generation and energy technology in 10 countries — Thailand, Indonesia, China, Australia, Lao PDR, Mongolia, Singapore, Japan, the United States of America and Vietnam. As of 31 June 2020, Banpu’s assets totaled USD 8,607 million, an increase of USD 538 million compared to the total assets as of 31 December 2019.