Banpu Completes the Acquisition of “Barnett” Shale Early to Benefit from Gas Price Increase in Winter; Steering Expansion of Natural Gas Portfolio in the U.S., Emphasizing Its Strategy for Energy Sustainability for the Future

Banpu Public Company Limited, an international versatile energy provider, completed the acquisition of a gas operation in the Barnett shale in Texas, thus, three months ahead of schedule with a net investment value of USD 489.80 million (equivalent of THB 15,407.89 million)*. The early closing date allows Banpu to benefit from the increased gas price during winter. This translates to instant cashflow and raises the contribution from Banpu’s two shale gas operations in the U.S. to 10% of the Company’s total EBITDA this year. The contribution is expected to increase further as the gas price forecast goes higher next year. This reflects Banpu’s smart investment and timely deal closing in line with Greener & Smarter strategy. Investment in natural gas presents low risk thanks to the existing infrastructure and transportation system to support the business. Banpu’s team of professionals from both Thailand and the U.S. possess broad expertise in natural gas business, high safety standards and the technology that helps optimize product value. With lean operation that focuses on cost management and efficiency improvement, it is expected that the gas business will continue to grow and become one of Banpu’s strongest businesses in the near future.

Mrs. Somruedee Chaimongkol, Chief Executive Officer of Banpu Public Company Limited, said “Natural gas is a bridging fuel, which is a key linkage during the transition from low-cost fuel to the future of renewable energy. The natural gas business is not only in line with Banpu’s Greener & Smarter strategy, but also its growing demand is forecasted to continuously trend up until 20501. As a result, Banpu continuously seeks to explore opportunities for investment while aiming to invest at the right moment. This is to generate steady income as well as encourage a significant increase in the EBITDA contribution from the natural gas business under our portfolio.”

At the end of last year, we entered into the Purchase and Sale Agreement (PSA) through Banpu North America Corporation Company Limited (BNAC) – a Banpu subsidiary responsible for managing the shale gas business in the U.S. – to acquire a gas operation in the Barnett shale, located in Fort Worth Basin, Texas. With a strategy to invest in low-risk, operating natural gas shale assets, we decided to close the deal sooner than originally planned in December 2020 so that we can realize revenue and generate cash flows for the Company immediately, just in time when gas price is about to rise.”

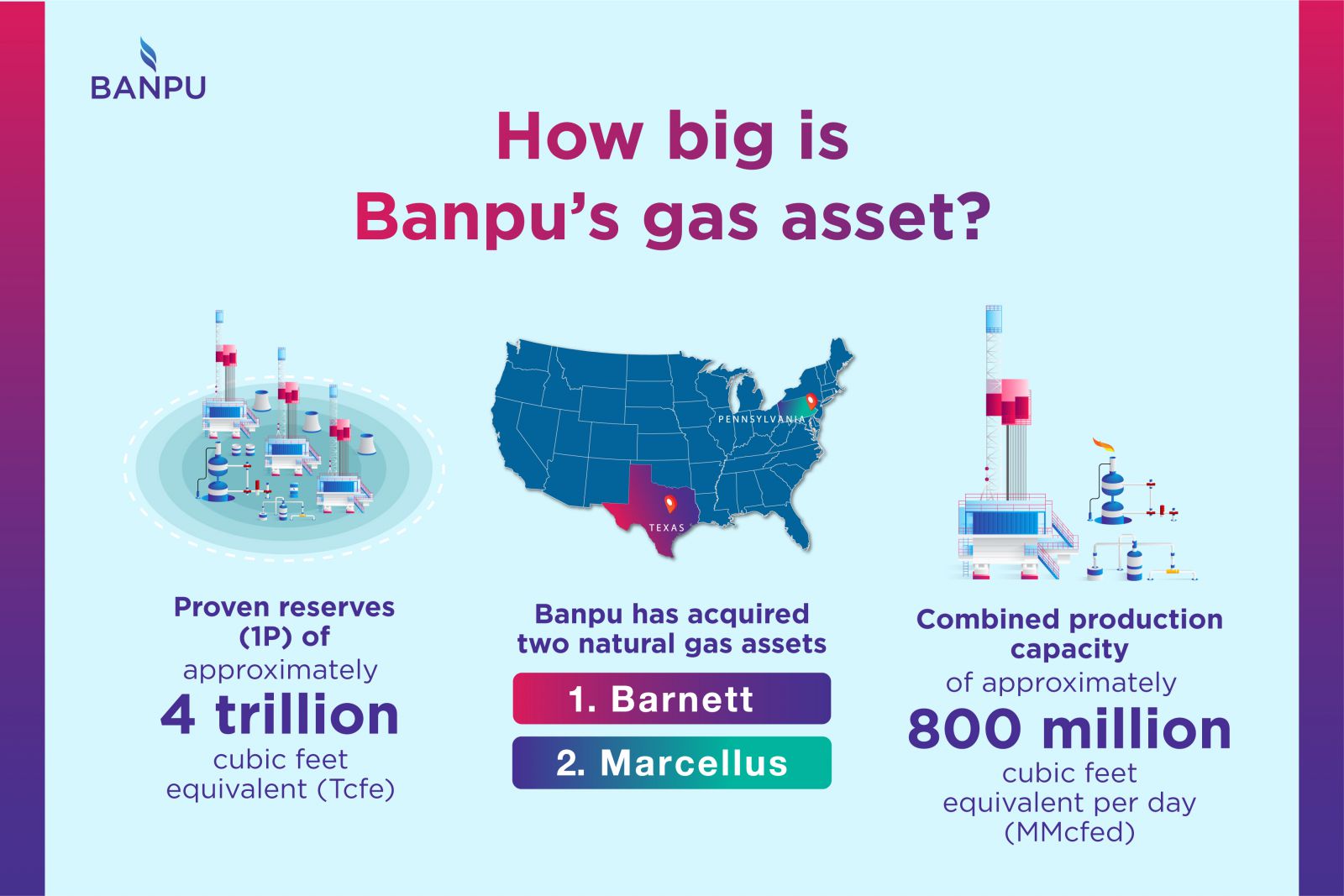

Banpu was the first Thai company to invest in natural gas business in the U.S. The Company initially invested in the Marcellus shale, which occupied over 104,000 square miles covering the states of Pennsylvania, West Virginia, East Ohio and West New York. The total investment value is USD 522 million or more than THB 15,000 million, with an average production capacity of 170 – 200 million cubic feet per day (MMcfd). This year marks the fifth year that Banpu has invested in the natural gas business in the U.S. which is a large growing market. In addition to opening an office in Tunkhannock, Pennsylvania, Banpu has also secured a team of professionals with broad expertise of the oil and shale gas industries from both Thailand and the U.S. to drive its business growth.

With investment in the Barnett shale at Fort Worth Basin, which is a major petroleum production area from the north of central Texas to the southwest of Oklahoma, Banpu has invested USD 489.80 million or approximately THB 15,407.89 million. The acquisition made Banpu the largest natural gas producer in the Barnett shale with over 4,200 wells, covering an area of more than 350,000 acres, with the gas proven reserves (1P) of approximately 3.5 Trillion Cubic Feet Equivalent (Tcfe) and approximately 600 Million Cubic Feet Equivalent Per Day (MMcfed). Barnett shale asset has the capacity per day to produce electricity for an area equivalent to Bangkok, Nonthaburi and Samut Prakan for up to 1.2 days.

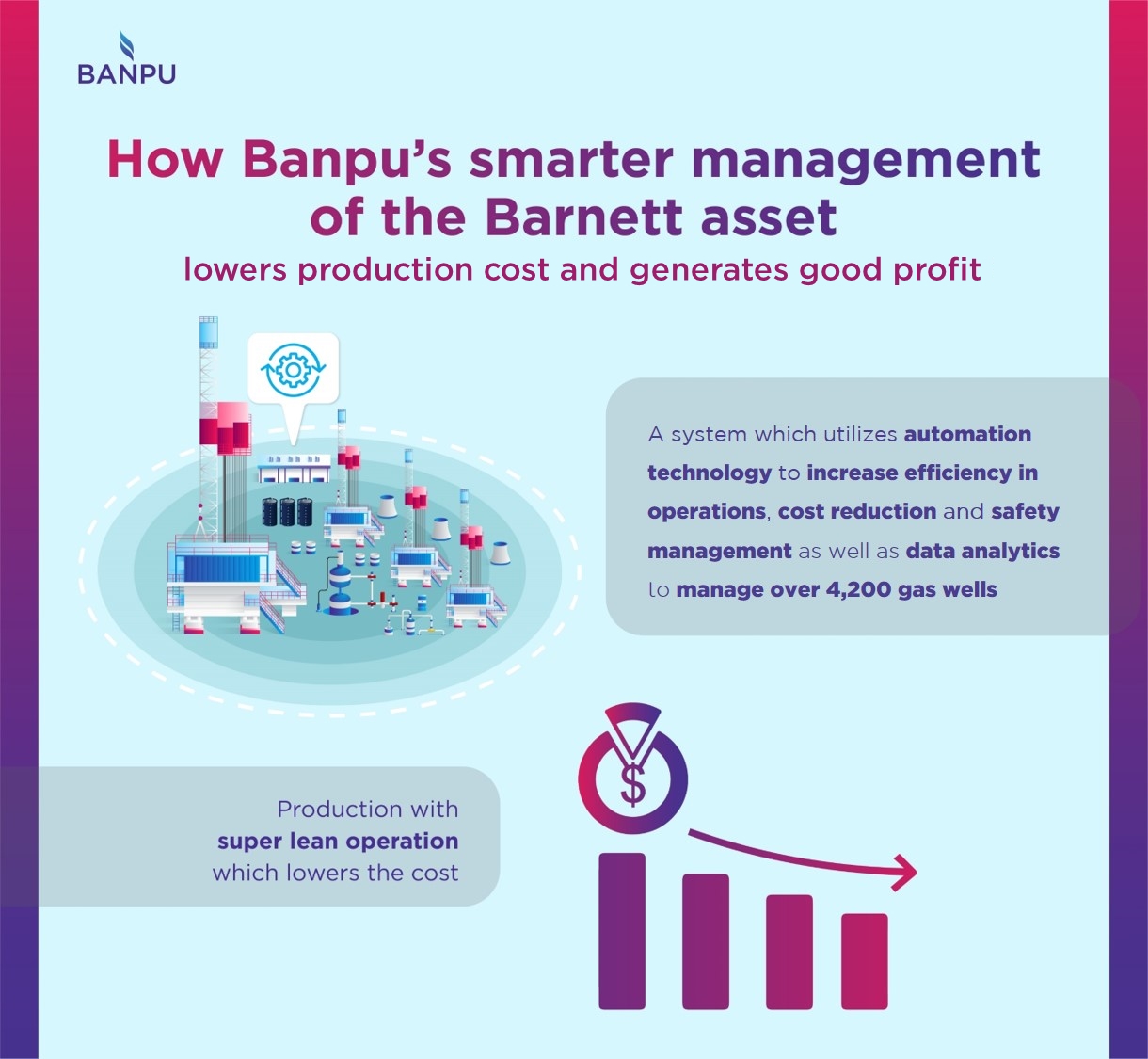

Mr. Thiti Mekavichai, Head of Oil and Gas Business, Banpu Public Company Limited, said “Combining the two natural gas operations that we have acquired, Banpu will have proven reserves (1P) of approximately 4 Trillion Cubic Feet Equivalent (Tcfe) with a production capacity of approximately 800 Million Cubic Feet Equivalent Per Day (MMcfed). The figure puts Banpu with the top 20 biggest gas producers in the U.S. with a gas reserve of at least 12 years, an estimate that can increase in our favor depending on the price factor. This is a competitive advantage for us, not to mention that we can synergize between our two resources, adding value from exchanging knowledge in the production process and automation technology as well as data analytics to better manage more gas wells through lean operation. And in the end, it improves productivity, reducing costs and enhancing safety. Banpu is confident that the natural gas business in the U.S. will continue to grow and bring in more value to the Company.”

“Banpu will continue to seek an opportunity to expand our value chain of gas business including natural gas distribution through pipelines, while constantly looking for additional investment opportunities to increase production capacity. The natural gas industry in the U.S. tends to grow strongly as the country has a large domestic market with less impact from outside factors, not to mention the need for natural gas to be utilized in a variety of ways, such as using as fuel in power plants and industrial plants or using in the LNG production, etc. Banpu is ready to accelerate the growth and stability in the natural gas business in the U.S. to generate steady cashflow and returns for our stakeholders. This is to reinforce our position as an international versatile energy provider that is poised to create a sustainable future for energy,” added Mrs. Somruedee.

*Remarks

Regarding terms & conditions under Purchase and Sale Agreement (PSA) for acquisition price of USD 570 million consisted of USD 80.2 million cash purchase price deduction from the Barnett’s operation and other adjustments since 1st September 2019 in which Banpu has the right to deducted from the investment value upon the closing date of transaction.

# # #

About Banpu

Banpu Public Company Limited is a leading integrated energy solutions company with 3 core groups of businesses; energy resources, energy generation and energy technology in 10 countries: Thailand, Indonesia, China, Australia, Lao PDR, Mongolia, Singapore, Japan, the United States of America and Vietnam. As of 31 December 2019, Banpu’s assets totaled USD 8.542 billion, an increase of USD 88 million compared to the total assets as of 31 December 2018.